Packaging Corporation of America, the nation’s third-largest containerboard producer, announced permanent cuts at its Washington mill, eliminating 200 jobs and taking a $205 million charge. This came just 92 days after a $1.8 billion acquisition of Greif’s mills.

Industry observers suggest PCA acquired lower-cost mills while planning to exit high-cost capacity. Could strategic consolidation be hiding behind expansion?

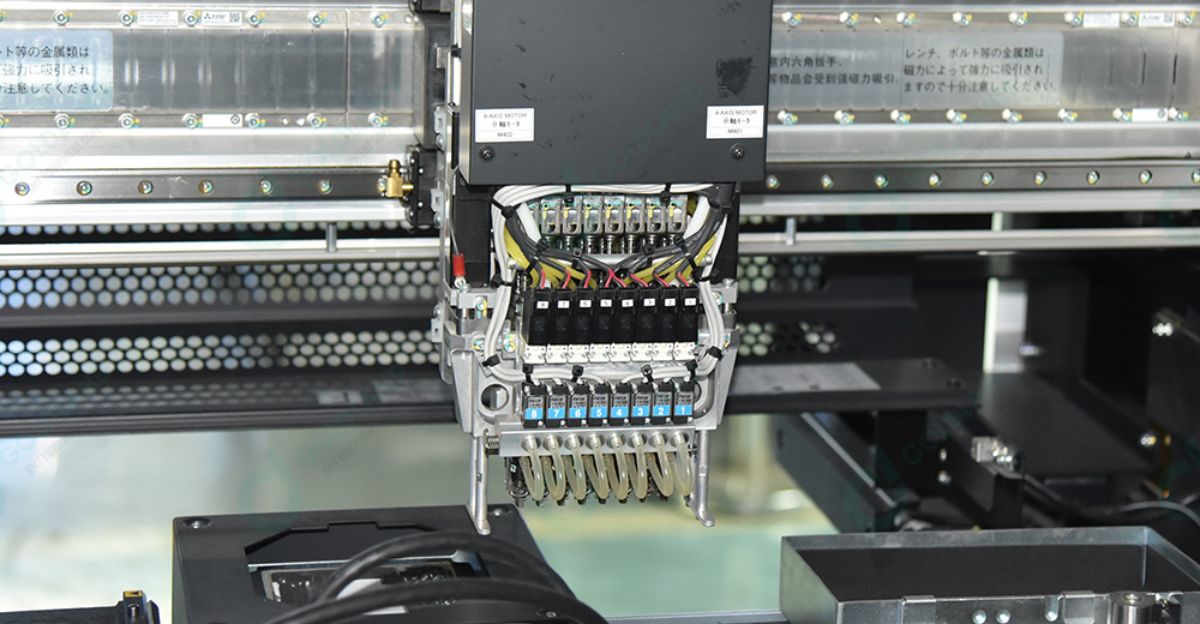

Understanding What “250,000 Tons” Really Means

Cutting 250,000 tons of capacity translates to 500 million pounds of paperboard annually, enough for 17 million corrugated boxes every day. Wallula will shrink from 400,000 tons to 285,000 tons yearly, converting to a recycled-fiber-only mill.

This isn’t simple downsizing—it’s a complete operational transformation. The scale of change hints at wider ripples across the industry.

The Mill’s Decline Started Earlier Than Most Realize

The W2 machine was idled in May, following intermittent closures over two years. Management labeled them temporary, but the pattern reflected deeper struggles, as the mill could not justify its costs amid volatile market conditions.

Investors began sensing Wallula’s terminal trajectory by fall. Early warning signs were easier to overlook than they seemed.

Why Now? The Q3 Earnings Confession

Third-quarter earnings came in at $2.51 per share, missing analyst forecasts of $2.81. Revenue matched $2.31 billion, yet profitability sank due to freight costs, weakening demand, and trade uncertainties, CEO Mark Kowlzan explained.

The recently acquired Greif mills were bleeding money, forcing PCA into stark operational decisions. Pressure on margins left no room for delay.

“We Face a Challenging and Worsening Cost Environment”

CEO Mark Kowlzan highlighted high costs in wood fiber and purchased power. Wallula’s location in Washington made it less competitive than mills in Tennessee, Alabama, or Ohio, he noted.

Reconfiguring to recycled-only operations would save $125 per ton, amounting to $31.25 million annually. Cost pressures demanded action, not gradual adjustment.

The Math Behind the Charge—It Gets Darker

The $205 million charge splits into $165 million in non-cash asset write-downs and $40 million in cash for severance and closure. This equates to $1,025,000 per worker.

PCA essentially admits Wallula’s machinery has near-zero resale value. The financial reality leaves little choice but a full shutdown.

The 200 Workers With 3 Months to Find New Jobs

Unionized employees at Wallula face layoffs by March 31, 2026. They have roughly three months to secure work in a struggling local labor market, with severance discussions ongoing.

PCA promised support and emphasized employee performance isn’t the issue, yet the human impact is unavoidable. How will the community absorb this blow?

The Regional Economic Earthquake

Wallula’s 200 lost jobs represent nearly 50% of the local workforce. Walla Walla County’s manufacturing-heavy economy cannot absorb the shock easily, given slow population and employment growth.

The job loss is a severe blow. For a small town under 300, the economic ripple effects could last years.

Greif Acquisition: The Strategic Bet That Triggered Wallula’s Fate

PCA acquired Greif’s containerboard business for $1.8 billion, adding two mills with 800,000 tons capacity. CEO Kowlzan had promised “significant synergies with minimal capital investment.”

Those synergies largely came from closing underperforming mills like Wallula. Growth was disguised as consolidation, a subtle but impactful shift.

The Paradox Explained—Consolidation Disguised as Contraction

PCA’s pre-acquisition market share was 10% in North America. Post-acquisition, it rises to 16%, yet high-cost Wallula capacity was cut.

Replacement comes from cheaper locations like Jackson, Alabama. The move is a textbook consolidation strategy, though it temporarily leaves a market gap.

The 9-Month Capacity Void Reshaping the Market

Wallula closes on March 31, 2026, but replacement capacity won’t be online until Q4, leaving a 9-month gap of 250,000 tons.

Containerboard capacity in North America fell by over 10% in 2025—the most significant drop since 2008. The short-term shortage could influence box pricing and supply chains.

A CEO’s Compensation Towers Over Worker Severance

CEO Kowlzan earned $15.67 million in 2024, 184 times the median employee pay of $85,079. Compensation included $10.63 million in stock awards.

By contrast, the 200 laid-off workers share a $40 million severance pool. One CEO earns as much as 78 employees combined, a stark contrast.

The Industry’s Historic Reckoning—2025’s Bloodbath

Wallula is one domino in a broader upheaval. International Paper cut 1.43 million tons and 1,100 jobs. Georgia-Pacific and others announced similar reductions.

RaboResearch calls 2025 one of the most challenging years for the containerboard industry. The industry is facing its third consecutive downturn, with a slight recovery expected by 2027.

The Post-Pandemic Box Boom Turned to Bust

Pandemic-era e-commerce drove containerboard demand to unprecedented heights, but 2024 revealed an oversupply. PCA’s Q3 2025 report showed a 38,000-ton production decline and a 2.7% sales drop.

Normalized inventory and inflation-driven retail pressure brought the boom to an end. The pandemic excess has vanished, exposing vulnerabilities in older facilities like Wallula.

Why Wallula Lost to Other Mills—Geography Is Destiny

High electricity rates and scarce local wood fiber made Wallula an expensive operation. Recycled-only operations would save $125 per ton, yet PCA chose shutdown over reconfiguration.

Production moved to Gladstone, Virginia. Wallula’s location sealed its fate despite potential efficiency gains, a cost of geography in a ruthless industry.

The Payback Period: A Troubling 6.5 Years

$31.25 million in annual savings versus a $205 million charge yields a 6.5-year payback period, exceeding the typical 3–5-year corporate horizon.

Wallula’s closure reflects desperation. Even painful restructuring is preferable to continued operation. Does the market see the long-term math as viable?

Analysts Defend the Math—But With Caveats

Truist Securities analyst Michael Roxland notes cost-driven capacity adjustments improve efficiency at other mills. “Tons transferred elsewhere could see even greater cost improvement,” he said.

Yet with recovery not expected until 2027, delayed demand raises risks. The math works now, but future profits are uncertain.

The Union’s Quiet Negotiation—And What It Signals

PCA is “scheduling time to discuss details with the Union,” suggesting non-union employees may already be gone. Severance terms aren’t finalized.

The disclosed $40 million pool may be a floor, not ceiling, as contracts could demand additional benefits. Actual costs remain opaque.

The Broader Lesson—Consolidation Eats Market Share, Not Growth

The $1.8 billion acquisition and $205 million restructuring reveal a strategy: survival through consolidation rather than expansion. High-cost mills are cut, market share increases.

Industry-wide behavior mirrors this. By 2027, fewer but larger competitors will dominate, shaping a more profitable, though ruthless, containerboard market.

The Final Word—Ruthlessness Is the Industry’s New Normal

CEO Kowlzan was precise: Wallula cannot compete. Workers must find new roles or leave, the community absorbs tax losses, and the market fills capacity gaps.

Industrial restructuring rewards capital but punishes workers and small towns. Wallula is a glimpse of 2026, where strategy outweighs human cost.

SOURCES:

“Packaging Corp to shut down paper machine at Wallula mill,” Investing.com, December 3, 2025

“PCA Reconfigures Wallula Containerboard Mill, Cuts 200 Jobs,” Paper Advance, December 7, 2025

“Packaging Corp to Cut 200 Jobs, Take $205M Charge for Mill Changes,” MarketWatch, December 3, 2025

“Packaging Corporation Announces Wallula Mill Reconfiguration,” Yahoo Finance, December 3, 2025

“PCA to shut down machines in Washington, affecting 200,” Packaging Dive, December 3, 2025

“PCA completes $1.8B purchase of Greif’s containerboard business,” Recycling Today, September 3, 2025